Ned Shaw

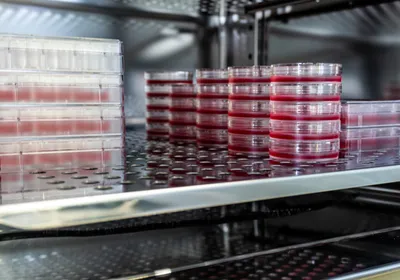

In the late 1990s, the UK Department of Trade and Industry began a program to boost highly skilled employment by financing biotechnology incubators. At the launch of the Biotechnology Mentoring and Incubator (BMI) Challenge, the United Kingdom could boast just two incubators, and as a part of the challenge the DTI awarded €4.9 million to 13 companies. The money went to incubators that provided lab space and equipment and also to organizations that provided just mentoring and management advice.

Today the United Kingdom has 22 incubators, including eight of the original BMI candidates. The DTI estimates that these eight have catalyzed 137 firms, or slightly more than 40% of 330 UK biotechnology companies. The businesses hatched in DTI-funded incubators employ 903 people, and they have raised more than €307 million in external funding.

The numbers sound seductive. But today, after a long dry venture capital investment cycle, particularly ...