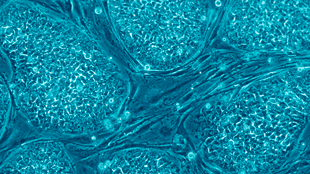

Embryonic stem cellsWikimedia, Nissim BenvenistyNearly a year after Geron discontinued its human embryonic stem cell (hESC) research, including the first ever US Food and Drug Administration-approved human trial for a hESC treatment, the company has received an offer to buy the entire program. Last month (October 18), former Geron CEOs Thomas Okarma and Michael West, now at the human stem cell-focused company BioTime, issued an open letter to Geron’s shareholders proposing the purchase of Geron’s stem cell and regenerative medicine business.

Embryonic stem cellsWikimedia, Nissim BenvenistyNearly a year after Geron discontinued its human embryonic stem cell (hESC) research, including the first ever US Food and Drug Administration-approved human trial for a hESC treatment, the company has received an offer to buy the entire program. Last month (October 18), former Geron CEOs Thomas Okarma and Michael West, now at the human stem cell-focused company BioTime, issued an open letter to Geron’s shareholders proposing the purchase of Geron’s stem cell and regenerative medicine business.

With talks underway, neither Geron nor BioTime would comment on the pending deal, although current Geron CEO John Scarlett said during a recent earnings call that the company is assessing a “complex” proposal. According to Okarma and West’s letter, the deal could involve $40 million of BioTime stock and a 45 percent ownership stake in a new publicly traded company that will own Geron’s assets.

The offer couldn’t come at a better time for Geron, which in recent months has started to feel pressure from its shareholders to boost its stock price and move products through the pipeline. Since last November, when the company announced its decision to shutter its hESC and regenerative medicine business and funnel its resources into developing telomerase-related treatments for cancer, ...