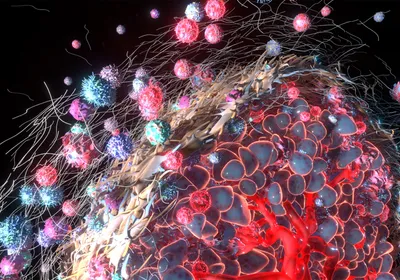

ABOVE: © ISTOCK.COM, JETCITYIMAGE

Pharmaceutical giant Eli Lilly announced yesterday (January 7) that it would buy Loxo Oncology for around $8 billion.

"We’d like to grow our presence in oncology. We have a good set of medicines there but we’d like to expand that because there’s so much exciting science for patients emerging in oncology to invest in," Lilly CEO David Ricks tells CNBC.

Loxo’s cancer drugs target gene abnormalities identified during genomic testing. The company’s leading treatment, LOXO-292, homes in on changes to the RET (rearranged during transfection) kinase, which pop up in multiple tumor types, including lung and thyroid cancers. It’s earned a Breakthrough Therapy designation from the US Food and Drug Administration (FDA). Another drug in the company’s portfolio is larotrectinib (Vitrakvi), which inhibits a specific receptor kinase that promotes tumors and has shown promise in treating cancers in the lung, colon, breast, and thyroid. It earned ...